Read More

Home budgeting for beginners

The cost of living crisis has forced plenty of Aussie households to look at what they’re spending. Our experts reveal how to set yourself an effective budget and stick to it.

Honesty and flexibility are two important attributes when it comes to creating a budget you’ll stick with, experts say.

Australia’s cost of living crisis and 12 interest rate hikes in 14 months have seen Aussies go back to the drawing board with their finances and look for new ways to cut down on costs. Budgeting is back.

While the thought of seeing all those expenses added up can be a tad overwhelming, a little bit of know-how and some free and easy budgeting tools means taking charge of your finances has never been easier.

First step – add up all your expenses.

NOW IS THE TIME

July figures from comparison site Finder show a growing number of Aussie workers are struggling to make ends meet, with more than half living from paycheck to paycheck each month.

Roughly a third say they are extremely stressed with their current financial situation and a further 51 per cent say they are ‘somewhat stressed’.

Finder personal finance specialist Angus Kidman said Aussies were rethinking their spending amid a cost of living crisis.

“Budgets are back in a big way,” he said.

Finder personal finance specialist Angus Kidman.

But it’s not just those who are struggling financially that could benefit from starting a household budget, said Canstar’s editor-at-large and money expert Effie Zahos.

“Whether you’re earning $80,000, or $280,000, the budget is the foundation of creating wealth,” she said.

“It’s as simple as that.”

WHERE TO BEGIN

MyBudget founder and director Tammy Barton suggests thinking about the “why” before you begin.

“Maybe you are tired of living week-to-week. Perhaps you’re saving for something special, like a house or a holiday,” she said.

“Outline your goals as they’ll continue to motivate you throughout your budgeting journey.”

Ms Zahos suggests an old-school approach using highlighters.

Founder and director of MyBudget Tammy Barton. Picture: Sarah Reed

“Print out that bank statement,” she said.

“Have a look to see where your money is coming in and where it is going out.”

Highlight all the essential fixed spending, like rent, mortgage repayments and bills, in one colour and all the discretionary spending, like takeaway coffee, eating out and other luxuries, in another.

“There should be a sea of colour there,” she said.

Then it’s a matter of seeing if you can shrink your fixed spending by getting a better deal with providers.

Canstar’s cost of living index shows the average amount people are paying on different services and the amount they could save by switching to the best value deal.

“It always pays to move around,” she said.

Canstar’s editor-at-large and money expert Effie Zahos.

Ms Barton said once you have a good idea of your expenses, it’s time to calculate your income after tax, including wages, Centrelink payments, child support and side hustle dollars.

“Make sure your income covers your expenses and leaves some room for savings. You absolutely need a surplus,” she said.

If you find you are going backwards and you have already gotten the best value for everyday expenses, it’s time to look at cutting back on luxuries or starting a side hustle, said Ms Zahos.

PICK YOUR BUDGET

There are three main types of budget to choose from, Mr Kidman said.

“One popular strategy is the ‘50/30/20 budget’,” he said.

“This is where you divide your money into three different buckets: needs, wants and savings. From here, 50 per cent of your income is allocated towards needs (housing, bills, groceries), 30 per cent is allocated towards wants (eating out, Netflix, weekends away, shopping) and 20 per cent is put towards your savings.”

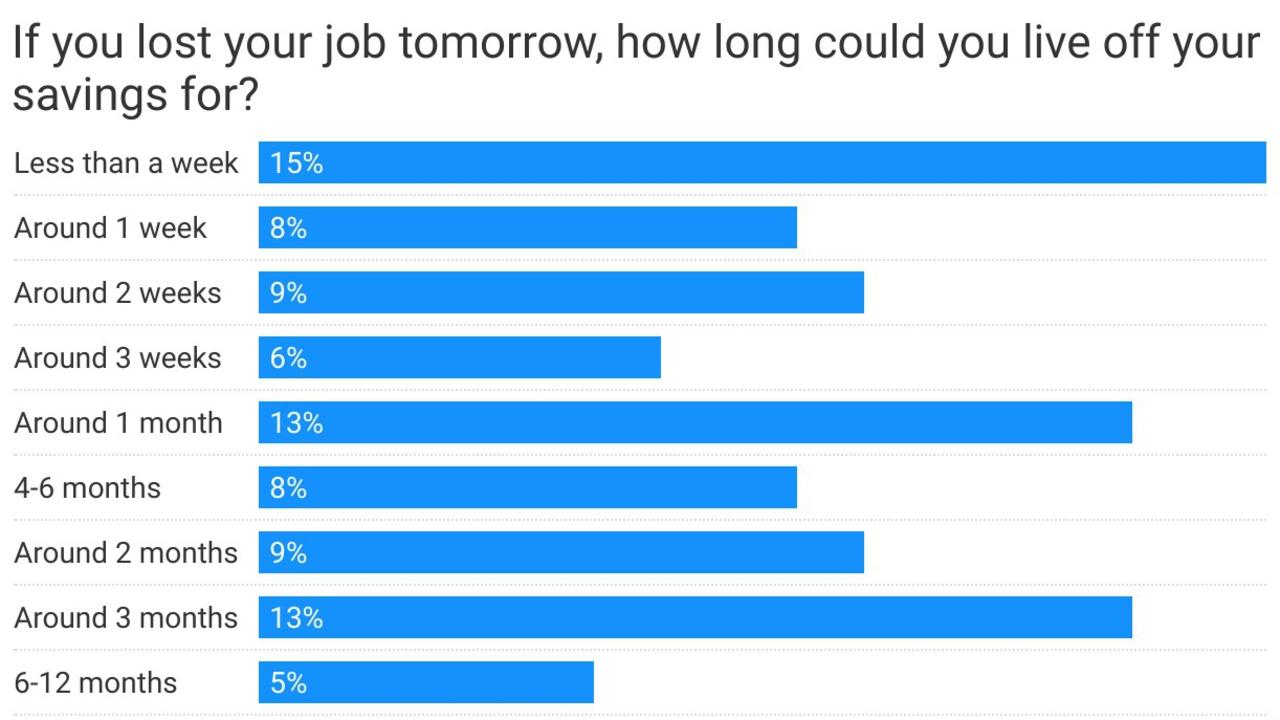

July data from Finder’s Consumer Sentiment Tracker shows half of Australian workers (51 per cent) live from paycheck to paycheck.

Ms Zahos said she uses a “zero-based budget” by adding up all of her expenses for the year and dividing it by 26 (because she gets paid fortnightly).

She allocates her pay into different bank accounts for each type of expense and has a separate account called “splurge” for luxury items. This limits the amount she can spend via “tap and go.”

“Then there’s the ‘pay-yourself-first budget’,” Mr Kidman said.

This is where you set yourself a savings goal each month and ensure you meet it before you pay for anything else.”

USE THE RIGHT TOOLS

There are plenty of free budgeting tools available online. Finder and Canstar both have free budgeting apps while My Budget offers a template. The government’s Moneysmart website also has loads of tips and tools.

Starting a budget is the first step towards building wealth.

HOW TO STICK WITH IT

Flexibility is very important when starting out, said Ms Zahos. Having a buffer in place can help you deal with unexpected costs and if you use the zero-based approach you will need to inject your bills account with cash at the onset.

Ms Barton agrees.

“Life is going to throw its curve balls, there’s no way around that. No one saw the pandemic coming until it did, and we all know how that went with household budgets,” she said.

“A budget is only as effective as it is accurate,” she said.

“Getting started on your budget can be a confronting process but once it’s done and starts to provide clarity, you’ll wonder why you ever went without one.”

Originally published as Home budgeting for beginners